0 W Indian School Rd Unit 6852979 Unincorporated County, AZ 00000

Estimated payment $11,940/month

150

Acres

$13,957

Price per Acre

6,554,038

Sq Ft Lot

Highlights

- 150.46 Acre Lot

- Mountain View

- No HOA

About This Lot

This home is located at 0 W Indian School Rd Unit 6852979, Unincorporated County, AZ 00000 and is currently priced at $2,100,000. 0 W Indian School Rd Unit 6852979 is a home located in Maricopa County with nearby schools including Arlington Elementary School and Buckeye Union High School.

Property Details

Property Type

- Land

Est. Annual Taxes

- $2,630

Lot Details

- 150.46 Acre Lot

- Property is zoned R-43

Property Views

- Mountain Views

Schools

- Arlington Elementary School

Community Details

- No Home Owners Association

Listing and Financial Details

- Assessor Parcel Number 506-30-001-A

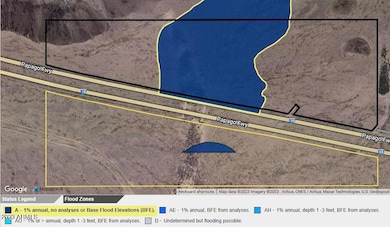

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,630 | $26,863 | $26,863 | -- |

| 2024 | $2,538 | $25,584 | $25,584 | -- |

| 2023 | $2,538 | $26,880 | $26,880 | $0 |

| 2022 | $2,505 | $23,205 | $23,205 | $0 |

| 2021 | $3,568 | $31,755 | $31,755 | $0 |

| 2020 | $3,551 | $44,325 | $44,325 | $0 |

| 2019 | $3,434 | $28,695 | $28,695 | $0 |

| 2018 | $3,398 | $28,695 | $28,695 | $0 |

| 2017 | $3,241 | $27,855 | $27,855 | $0 |

| 2016 | $3,207 | $35,415 | $35,415 | $0 |

| 2015 | $3,350 | $43,344 | $43,344 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 04/17/2025 04/17/25 | For Sale | $2,100,000 | -- | -- |

Source: Arizona Regional Multiple Listing Service (ARMLS)

Deed History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Quit Claim Deed | -- | -- | |

| Interfamily Deed Transfer | -- | None Available | |

| Interfamily Deed Transfer | $78,500 | None Available | |

| Interfamily Deed Transfer | -- | None Available | |

| Quit Claim Deed | -- | -- |

Source: Public Records

Source: Arizona Regional Multiple Listing Service (ARMLS)

MLS Number: 6852979

APN: 506-30-001A

Nearby Homes

- 0 W 491st Ave Ave #12 Ave Unit 12

- 490 W Lotus Ln Unit 29

- 0 Lotus Ln Unit 39 6827243

- 0 Lotus Ln Unit 34 6827233

- 48900 W Salome Hwy

- 49XXX W Ivy Ln Unit 41

- 4291 N 489th Ave

- 4289 N 489th Ave

- 4293 N 489th Ave

- 470XX N 475th Ave

- 0 S 483rd(approx) 4 Ave Unit 4

- 0 S 483rd(approx) 5 Ave Unit 5

- 0 S 483rd(approx) 3 Ave Unit 3

- 0 S 483rd(approx) 2 Ave Unit 2

- 0 S 483(approx) Ave Unit 1

- 487th Ave N of Indian School Rd A --

- 487th Ave N of Indian School Rd B --

- 475th Ave & Salome Hwy

- 470XF W Highland Ave

- 475XXX Unit A