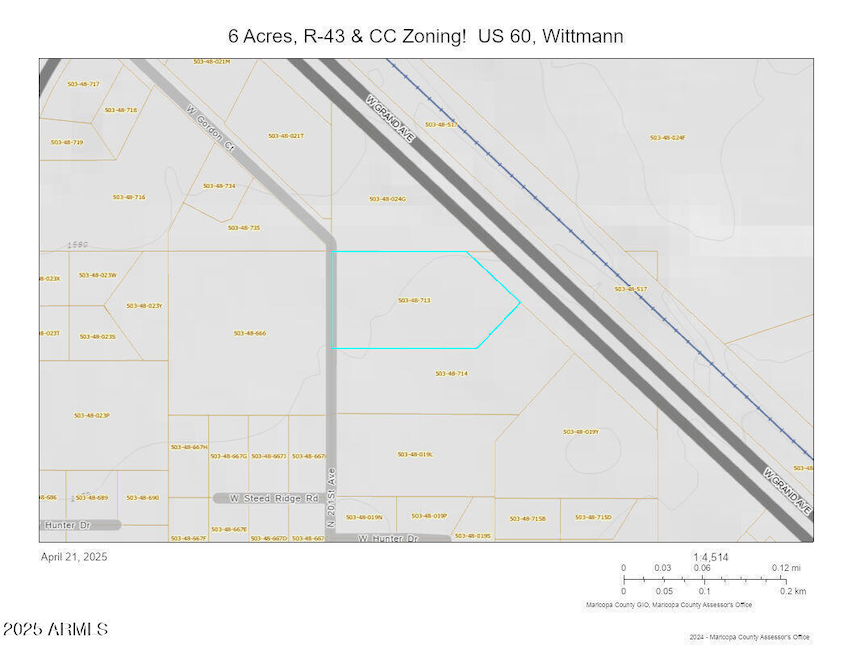

29329 N 201st (Appx) Ave Wittmann, AZ 85361

Estimated payment $5,158/month

6

Acres

$150,000

Price per Acre

261,360

Sq Ft Lot

Highlights

- 6 Acre Lot

- Cul-De-Sac

- Level Lot

- No HOA

About This Lot

6 ACRES Vacant Land with US 60 Frontage! Dual Zoned as R-43 AND Commercial Community ''CC'' so develop the commercial side and build your small subdivision OR RE-ZONE and use your imagination! Utilities are adjacent! Sellers have Surveys, Land Drainage, Compaction, and Building Plans for Warehouse and Mini-Storage available. TREMENDOUS GROWTH AREA so hurry before we increase the asking price! Sign Up Soon.

Property Details

Property Type

- Land

Est. Annual Taxes

- $1,622

Lot Details

- 6 Acre Lot

- Cul-De-Sac

- Wire Fence

- Level Lot

- Property is zoned R-43 & CC

Schools

- Desert Oasis Elementary School

Community Details

- No Home Owners Association

Listing and Financial Details

- Assessor Parcel Number 503-48-713

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,622 | $14,162 | $14,162 | -- |

| 2024 | $1,586 | $13,487 | $13,487 | -- |

| 2023 | $1,586 | $28,005 | $28,005 | $0 |

| 2022 | $1,197 | $18,090 | $18,090 | $0 |

| 2021 | $1,330 | $17,145 | $17,145 | $0 |

| 2020 | $1,323 | $15,165 | $15,165 | $0 |

| 2019 | $1,216 | $12,495 | $12,495 | $0 |

| 2018 | $1,199 | $11,385 | $11,385 | $0 |

| 2017 | $1,203 | $9,585 | $9,585 | $0 |

| 2016 | $1,462 | $12,600 | $12,600 | $0 |

| 2015 | $2,308 | $19,200 | $19,200 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 04/21/2025 04/21/25 | For Sale | $900,000 | -- | -- |

Source: Arizona Regional Multiple Listing Service (ARMLS)

Deed History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Cash Sale Deed | $400,000 | Arizona Title Agency Inc | |

| Warranty Deed | $304,250 | Arizona Title Agency Inc |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $219,250 | Seller Take Back |

Source: Public Records

Source: Arizona Regional Multiple Listing Service (ARMLS)

MLS Number: 6854852

APN: 503-48-713

Nearby Homes

- 0 W Peak View Rd Unit 6818512

- 0 W Peak View Rd Unit 195 6499472

- 0 W Gordon Ct Unit 6855163

- 20040 W Hunter Dr

- 20128 W Steed Ridge Rd

- 28848 NW Grand Ave

- 28813 N 201st Ave

- 0 N None Assigned Ave Unit 6830743

- 29785 N 203rd Dr

- 20324 W Melanie Dr

- 29215 N 205th Ln

- 00 N 205th Ave

- 20537 W Gordon Way

- 22216 W Skinner Dr

- 22232 W Skinner Dr

- 22254 W Skinner Dr

- 22270 W Skinner Dr

- 27805 N 203rd Ave

- 30579 W Redbird Rd

- 28721 N 201st Ave