42200 N 10th St Unit 22B Desert Hills, AZ 85086

Estimated payment $1,008/month

Total Views

6,526

1.01

Acres

$173,267

Price per Acre

43,996

Sq Ft Lot

Highlights

- City Lights View

- No HOA

- Gentle Sloping Lot

- New River Elementary School Rated A-

About This Lot

Beautiful Mountain & City light views. Hillside lot ready to go with utilities & shared well in place.

Property Details

Property Type

- Land

Est. Annual Taxes

- $383

Lot Details

- 1.01 Acre Lot

- Gentle Sloping Lot

- Property is zoned R-43

Property Views

- City Lights

- Mountain

Schools

- New River Elementary School

- Gavilan Peak Elementary Middle School

- Boulder Creek High School

Utilities

- Shared Well

Community Details

- No Home Owners Association

Listing and Financial Details

- Tax Lot 022B

- Assessor Parcel Number 211-70-022-B

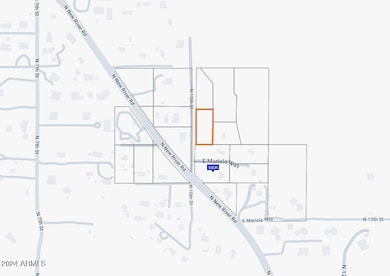

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $383 | $3,258 | $3,258 | -- |

| 2024 | $365 | $3,103 | $3,103 | -- |

| 2023 | $365 | $9,705 | $9,705 | $0 |

| 2022 | $352 | $7,785 | $7,785 | $0 |

| 2021 | $358 | $6,210 | $6,210 | $0 |

| 2020 | $351 | $4,995 | $4,995 | $0 |

| 2019 | $340 | $4,920 | $4,920 | $0 |

| 2018 | $329 | $3,510 | $3,510 | $0 |

| 2017 | $323 | $5,430 | $5,430 | $0 |

| 2016 | $296 | $6,135 | $6,135 | $0 |

| 2015 | $292 | $4,848 | $4,848 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 11/13/2024 11/13/24 | For Sale | $175,000 | -- | -- |

Source: Arizona Regional Multiple Listing Service (ARMLS)

Deed History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Warranty Deed | $22,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Open | $21,000 | Purchase Money Mortgage | |

| Previous Owner | $140,000 | Unknown |

Source: Public Records

Source: Arizona Regional Multiple Listing Service (ARMLS)

MLS Number: 6783421

APN: 211-70-022B

Nearby Homes

- 7XXX E Honda Bow Rd Rd

- 0 E Honda Bow Rd Unit 9K 6571603

- 42800 N 12th St

- 43718 N 12th St

- 43xxx N 12th St

- 42213 N 3rd St

- 20XX E Filoree Ln Unit K

- 20XX E Filoree Ln Unit J

- 20XX E Filoree Ln Unit H

- 1235 N Hohokam Ln

- 42812 N 14th St

- 42424 N 3rd St

- 43320 N 11th St

- Lot 5 N 16th St Unit 5

- Lot 4 N 16th St Unit 4

- Lot 3 N 16th St Unit 3

- Lot 1 N 16th St Unit 1

- Lot 2 N 16th St Unit 2

- 42419 N Central Ave

- XX E Honda Bow Rd Unit 13D