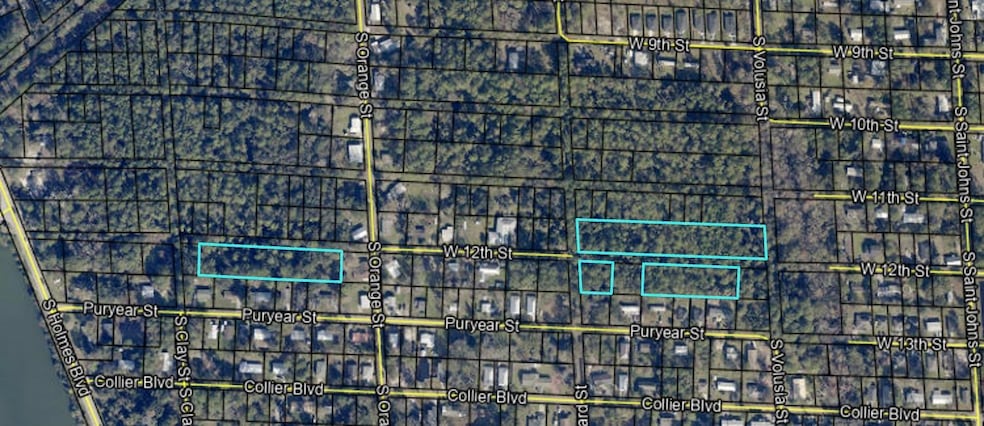

900 W 12th St St. Augustine, FL 32084

West Augustine NeighborhoodEstimated payment $1,197/month

Highlights

- 3.37 Acre Lot

- W. Douglas Hartley Elementary School Rated A

- Many Trees

About This Lot

This is an approximately 2.3 acre parcel located in West Augustine. There are 20 lots for sale. Each lot is approximately 50' x 100'. The available lots are 205 - 216 located on the N side of W 12th St, and lots 228 ,227, and 219- 224 located on the south side of W 12th St. There is no access to these lots. The parcel ID number reflects 9 additional lots within this parcel. These are not included in the asking price. Seller is willing to discuss pricing on these additional lots. Additional lots are located west of S Orange St and are lots 243- 251. Each lot is approximately 50' x 100'.

Property Details

Property Type

- Land

Est. Annual Taxes

- $1,002

Lot Details

- 3.37 Acre Lot

- Many Trees

- Property is zoned RS-3

Schools

- Murray Middle School

- St. Augustine High School

Listing and Financial Details

- Assessor Parcel Number 133690-2050

Map

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,002 | $134,228 | $134,228 | -- |

| 2023 | $1,002 | $127,662 | $127,662 | $0 |

| 2022 | $500 | $39,393 | $39,393 | $0 |

| 2021 | $463 | $35,016 | $0 | $0 |

| 2020 | $1,659 | $124,015 | $0 | $0 |

| 2019 | $1,739 | $124,015 | $0 | $0 |

| 2018 | $2,173 | $153,195 | $0 | $0 |

| 2017 | $1,266 | $87,540 | $87,540 | $0 |

| 2016 | $1,296 | $87,540 | $0 | $0 |

| 2015 | $1,208 | $79,771 | $0 | $0 |

| 2014 | $1,224 | $79,771 | $0 | $0 |

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 12/02/2024 12/02/24 | For Sale | $200,000 | -- | -- |

Deed History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Special Warranty Deed | $29,800 | Attorney | |

| Quit Claim Deed | -- | None Available | |

| Quit Claim Deed | $9,081 | None Available | |

| Deed | $100 | -- | |

| Public Action Common In Florida Clerks Tax Deed Or Tax Deeds Or Property Sold For Taxes | $20,699 | None Available | |

| Warranty Deed | -- | Ticor Title Ins Co Of Fl | |

| Corporate Deed | $200,000 | Action Title Services Of St |

Mortgage History

| Date | Status | Loan Amount | Loan Type |

|---|---|---|---|

| Previous Owner | $160,000 | Seller Take Back |

Source: St. Augustine and St. Johns County Board of REALTORS®

MLS Number: 245654

APN: 133690-2050

- 948 Collier Blvd

- 1042 Collier Blvd

- 1046 Collier Blvd

- 925 S Saint Johns St

- 0 W 7th St

- 1016 W 7th St

- 832 W 10th St

- 0 W 11th St Unit 1039887

- 0 W 11th St Unit 1039883

- 0 W 11th St Unit 2068223

- 0 W 11th St

- 764 W 11th St

- 809 W 7th St

- 859 W 6th St

- 821 W 6th St

- 1132 W 12th St

- 817 W 6th St

- 882 4th St

- 854 W 3rd St

- 855 W 4th